In light of the recent banking collapses and stock market calamity, President Trump warned that Joe Biden’s fiscal policies will lead to a new ‘Great Depression.’

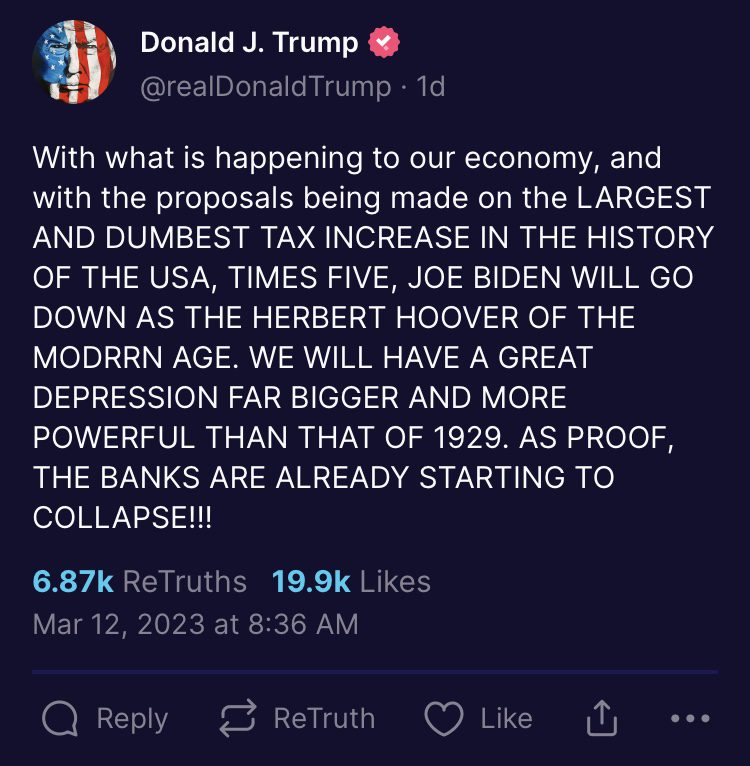

“With what is happening to our economy, and with the proposals being made on the LARGEST AND DUMBEST TAX INCREASE IN THE HISTORY OF THE USA, TIMES FIVE, JOE BIDEN WILL GO DOWN AS THE HERBERT HOOVER OF THE MODRRN AGE. WE WILL HAVE A GREAT DEPRESSION FAR BIGGER AND MORE POWERFUL THAN THAT OF 1929. AS PROOF, THE BANKS ARE ALREADY STARTING TO COLLAPSE!!!” Trump wrote on Truth Social.

Business Insider reported:

A Trump spokesman told Insider that “out of control Democrats and the Biden administration have continued to pathetically try to blame President Trump for their failures with desperate lies, such as the CCP spy balloons, the train derailment in East Palestine, and now the collapse of SVB.”

“This is nothing more than a sad attempt to gaslight the public to evade responsibility,” the spokesman told Insider.

The Federal Deposit Insurance Corporation shut down the Silicon Valley Bank on Friday following a catastrophic bank run. The collapse of Silicon Valley Bank has now become the largest bank failure in the US since the 2008 financial crisis.

The FDIC insures deposits for up to $250,000 per depositor, per institution, per ownership category. However, startups with money in Silicon Valley Bank exceeding $250,000 are now in danger of not being able to make payroll next week.

On Sunday, Senator Bernie Sanders blamed the Silicon Valley Bank collapse on the “Economic Growth, Regulatory Relief and Consumer Protection Act” signed by Trump in 2018.

My statement on Silicon Valley Bank. pic.twitter.com/dwB8xdhCwm

— Bernie Sanders (@SenSanders) March 12, 2023

As usual, leftists shrieked on social media that blame for the crisis should rest on Trump’s shoulders:

In 2018 President Trump signed a bill that rolled back Dodd-Frank regulations on banks like Silicon Valley Bank.

Prior to the bill, the threshold for which banks were required to submit resolution plans for their rapid and orderly resolution to the FDIC was set at $50 billion…

— Ed Krassenstein (@EdKrassen) March 11, 2023

Good time to reup this from 2018. https://t.co/CqK7qFLGdF

— Ron Filipkowski (@RonFilipkowski) March 11, 2023

Fox Business noted:

EJ Antoni, research fellow in regional economics with The Heritage Foundation’s Center for Data Analysis, told FOX Business on Saturday that the collapse had “nothing to do with Trump or Dodd-Frank” and more to do with an “unusual confluence of events.”

Antoni explained that the bank “dealt almost exclusively with tech firms which usually rely on continuously rolling over large debts” which means that the firms are “not paying off their debt but simply taking out new debt to pay off the old.”

“Second, SVB put a disproportionate amount of its cash into long-term bonds. Ordinarily, that’s not a bad strategy, but it’s unwise when interest rates are zero because those rates must rise eventually,” Antoni said. “When rates rise, bond prices fall. This is because an investor with the choice to buy an existing bond at a low rate or a new bond at a high rate will choose the new bond since it’s a better return on investment. If you want to sell the old bond with its lower interest rate, you must be willing to sell it at a discount; otherwise, no one will buy it.”

Antoni explained that SVB’s undiversified clientele meant “too many depositors needed cash all at once” forcing the liquidation of bonds that had lost value and a “death spiral” quickly ensued.

“SVB had to sell its bonds at a loss to raise cash,” Antoni said. “Limited transactions like this would not have been catastrophic, and in fact happen regularly in the financial sector on a small scale.”

“SVB was a case of mismanagement that was made possible by the unrealistically low rates from the Federal Reserve,” Antoni told FOX Business.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!