The Biden administration is responsible for the record inflation we are currently seeing.

Yes, every President has added to the inflation of our money supply, but Biden has taken that inflation to a 4 decade all time high by overseeing the printing of roughly 40% of all the U.S. Dollars in existence last year.

To be fair, President Trump presided over half of the 12 month period during the record inflationary printing.

What makes the Biden administration much more responsible for this crisis is the fact that they chose to continue Covid-19 lockdown policies which stifled the economy rather than open the economy back up.

These economic lockdowns coupled with the rampant printing of money led to the classic situation in which people had too much money, but not enough goods and services to spend that money on—i.e. inflation.

Inflation is not just a general rise in the price of goods. It is a general rise in the price of goods because there is more monetary supply than the sum total of goods and services available in any given society.

Inflation has been the government policy ever since Richard Nixon took us off the gold standard, and even before that we can see inflation present in various monetary systems including ours since the very start.

Politicians often have to choose between the forces of inflation and deflation, with inflation being the go-to option because it creates the illusion of wealth. Deflation on the other hand would lead to political suicide.

Imagine waking up everyday to find that the house you paid $500,000 for is worth less and less everyday, not a very ideal situation is it?

People would much rather hear that the house they paid $500,000 for is now worth $1.5 million 30 years later—despite the fact that this $1.5 million represents no real growth in real purchasing power or wealth.

The solution to this? Switching to a cryptocurrency which is limited from the outset—just like gold, but unlike gold Bitcoin adheres to strict mathematical principles, and takes a great deal less to mine for.

Governments the world over have begun to adopt Bitcoin as legal tender in what seems to be the beginning of the adoption of a Bitcoin standard.

A government or centralized bank cannot mint more Bitcoin no matter how hard it tries. There is a limited supply of 21 million Bitcoin which will be fully circulating roughly 100 years from now.

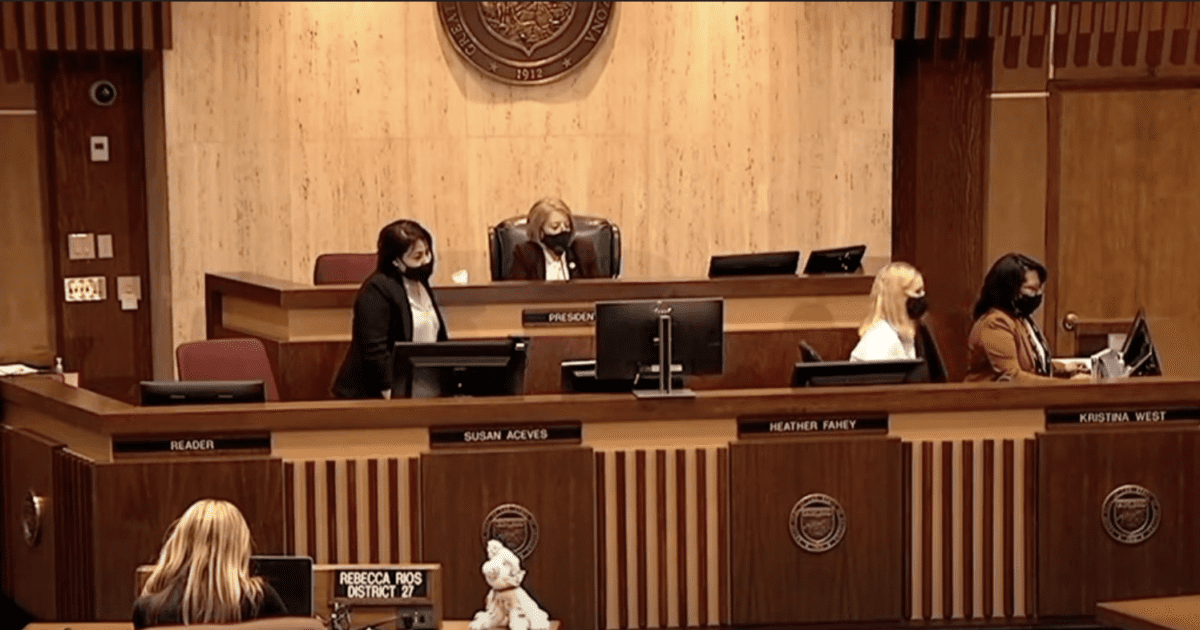

Because of these static properties, and because it now appears as if our fiat Dollar system is failing, Arizona is considering making Bitcoin legal tender:

A bill introduced on 1/25 in Arizona would define legal tender in the state. https://t.co/l6mpxMRR7Y #bitcoin #Crypto #blockchain pic.twitter.com/WMREgmY9zT

— CM (@JCS_155) January 27, 2022

Arizona State Senator @WendyRogersAZ has introduced a bill to make #bitcoin legal tender in Arizona.

💥💥💥💥💥 pic.twitter.com/b1iwYw241d

— BTC Times (@btc) January 28, 2022

Blockworks reports that the fight to make Bitcoin legal tender won’t be an easy one:

“The Coinage Clause of the Constitution means that the power to determine what is and isn’t legal tender in the United States is the exclusive province of Congress,” said Preston Byrne, partner at law firm Anderson Kill. “If enacted, [the bill] would be largely symbolic.”

In the 1800s, states tried to work around the Coinage Clause by issuing their own “state bank notes,” but they had little success. In the National Bank Acts of 1865 and 1866, Congress effectively put an end to the practice by placing a 10% tax on payments made in currency other than national bank notes.

The Texas governor race is a race to see who can be the most pro-#Bitcoin.

– Wendy Rogers, Arizona State Senator pic.twitter.com/96L56hzX7q

— Blockworks (@Blockworks_) January 31, 2022

IF Arizona succeeds in making #bitcoin legal tender then it is a VERY big deal!

It has around the same population as El Salvador, but it has more than 10X the GDP.

PLUS the implications of BTC being legal tender in a US state would be HUGE!

Don't expect it to be easy

— Lark Davis (@TheCryptoLark) January 30, 2022

On a national front, ProCoin News writes that one Democrat is planning on banning crypto altogether, as Democrats in general are seemingly in opposition of financial innovation:

Democrat US Representative Brad Sherman is hoping to ban cryptocurrency.

During a recent House Financial Services Committee meeting, Rep. Sherman stated that the rise of cryptocurrency needs to be “nipped in the bud”.

He followed up his statement by introducing a bill that would ultimately ban cryptocurrency.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!