Do we already have capital controls here in the USA and most don’t even know it?

Well, there’s a simple way to test it…go to your bank and try and withdraw all your funds.

See what happens.

Report back!

I think you’d be absolutely STUNNED to see what happens if you even TRY to do that….but more on that in a minute.

First, we go to AMTV for a report that funds are already being locked down in the United States and it’s about to get a lot worse on October 1.

Watch here:

More here:

🚨🚨🚨OCTOBER 1 DEADLINE!!!!!!! BANKS START RESTRICTING CASH ACCORDING TO REPO… https://t.co/mLXbBjGeC0 via @YouTube

— Christopher Greene 😎🏝🚀⛵️ (@amtvmedia) September 24, 2022

So, why are they restricting cash outs?

To prevent bank runs:

Cyber induced bank runs pose “huge risk”, says Richmond Fed’s Barkin – Central Banking https://t.co/ajH8ISqfHw

— Christopher Greene 😎🏝🚀⛵️ (@amtvmedia) September 24, 2022

Now let’s talk about what would happen if you tried to take your money out of a bank.

How much could you take?

Are there limits?

WHY are there limits?

Take a look at this:

When is the last time you tried withdrawing cash from a US bank 5-$10k or more?? I’m hearing reported problems and limits being set already. Pls comment

— Christopher Greene 😎🏝🚀⛵️ (@amtvmedia) September 24, 2022

A bunch of responses came in on that Tweet and I’m going to copy some of the ones that really caught my eye below…

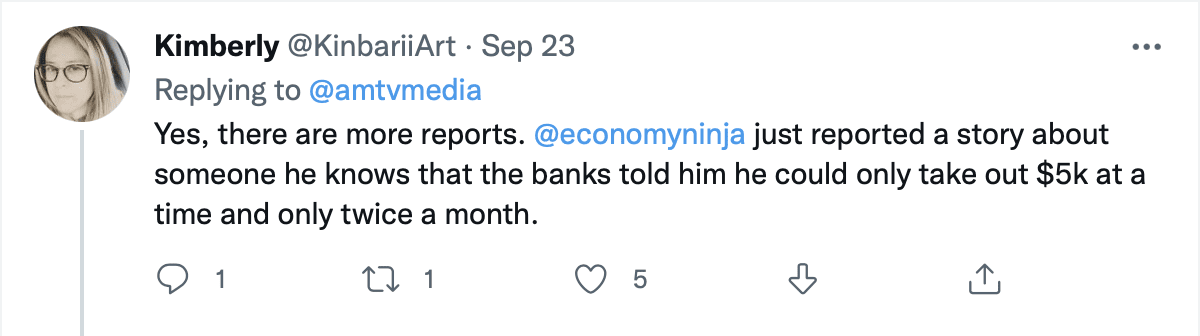

Check this one out…

He tried to withdraw $20,000 and the staff freaked out and had to huddle up!

Why?

Cause they don’t actually have the money???

This guy reports a $2,000 limit at BofA:

This guy nearly made PNC shut down over $15K and it took a week!

Another $5K limit reported here…

So I ask you this: when you put your money in the bank, is it still YOUR money or not?

Hmmmm:

$15K…took 16 days!

Why?

Did they have to go find the money?

Another $5K limit here:

It’s not only the withdrawals…

Try depositing a larger sum, you’ll get a million questions.

Where did I get this money?

I got it from NONYA!

“NONE YA BUSINESS!”

So what’s really going on here?

Are the banks insolvent?

Well, Fractional Reserve Banking would tell us they are.

By some estimates, Fractional Reserve Banking has allowed banks to lend out $9 for ever $1 on deposit.

In other words, they’re upside down by about 900%.

That’s not a problem is it?

So if that’s the reality of the situation, and if you were a bank, what would you do to prevent everyone from trying to withdraw all their money at once?

Why, you’d put low limits in place on how much they could withdraw…

You’d have long delays in doing so…

You’d hit them with a million questions, make them feel as awkward as possible, and in general make it an experience that they never want to go through again.

Now ask yourself, is that the EXACT experience being reported by everyone above?

Things that make you go “hmmmmm”.

Study up on Fractional Reserve Banking:

https://twitter.com/nwob0t/status/1574326687428481025

Much more here:

https://twitter.com/nwob0t/status/1574168141311389696

It’s often said that if the public truly understood what these banks were doing, this would be the result:

https://twitter.com/rebelpuss/status/1574377802110889985

Because of this:

Can we change the phrase "Fractional reserve banking" to "almost no reserve" banking … or "we took your money to the casino" banking? pic.twitter.com/KyKspIirUa

— lefty 🇸🇻🇵🇾🇳🇬🇺🇦🇵🇦🇨🇭🇦🇪🇨🇱🇭🇳🇧🇷 (@CryptoBananas) September 25, 2022

This guy nailed it:

Fractional reserve banking. Exchanges are probably utilizing this as well. That's why you never keep any substantial funds in banks or on exchanges. https://t.co/jhALBtFOQd

— GENERATION HODL (@changeson) September 20, 2022

And I love this one…

Asking: “Did I fall for a hoax?”

Well, we report, you decide…

Is this the greatest ponzi scheme of all time?

🤷 didn't USA go off fractional reserve banking in 2020?

Did I fall for a hoax? https://t.co/4ler2BKE6V

— 🇺🇦 Ben (Benjamin) Garth Siddhartha Mack (@BenMack) September 25, 2022

Backup here:

#FractionalReserveBanking – do you own some #silver /#gold yet? #GreatReset #CBDC https://t.co/fqm0jeOdlx

— Zine Scene (@Zine_Scene_) September 18, 2022

It looks like the Pope knows this already:

Pope Francis Orders All Church Funds To Be Sent To Vatican By September 30th!

HEADS UP FOLKS!

Something major is coming.

Do NOT underestimate the global power of the Vatican.

Is a major financial collapse coming?

It would be reasonable to be concerned after seeing the unprecedented step Pope Francis just took.

Take a look:

https://t.co/UC1yhlNmYn

Pope Francis orders all Vatican affiliated entities &church orders to transfer ALL FUNDS&assets to the Vatican Bank by 9/30.Institutions connected w/the Holy See that are holders of financial assets &liquidity,in whatever form they are held.

GESARA Inbound pic.twitter.com/jDjUHKw8IY— BKJN Annie Lee (@BkjnLee) August 27, 2022

Why Pope Francis’ Vatican bank order is such a big deal….. – https://t.co/ZqnEyD81ru pic.twitter.com/bNx6YskHdo

— Whazupnaija (@Wazupnaija) August 26, 2022

The rescript issued by Pope Francis this week, ordering all Vatican offices to deposit their funds in the Vatican bank, represents a reversal of the policy that the Pope himself set earlier this year in Praedicate Evangelium, says Ed Condon of The Pillar. https://t.co/4xnqhoNvxE

— Father V (@father_rmv) August 24, 2022

Pope Francis orders all Church funds and assets to be liquidated to the Vatican bank by Sept 30, 2022. Buckle up yall. Read EO 13818 and 13848. pic.twitter.com/mgSOr074Ip

— 🌟Rusti Shackleford (@RustiSchacklef1) August 26, 2022

Worldwide economic crash incoming?

Something worse?

What’s funny is I just had Bo Polny on my show last week and he told me the EXACT same thing.

He didn’t know about the Pope, but he said his research is showing something historic (and not good) comes in September.

Worldwide financial collapse.

You can see that here:

Bo Polny: The Fireworks Start In September! Bitcoins Massive Move…

Should you be concerned?

Probably so!

I can make a case for why this should spook you. Do not under estimate the geopolitics of the Church...https://t.co/XFED63DWpW

— Dave Collum (@DavidBCollum) August 26, 2022

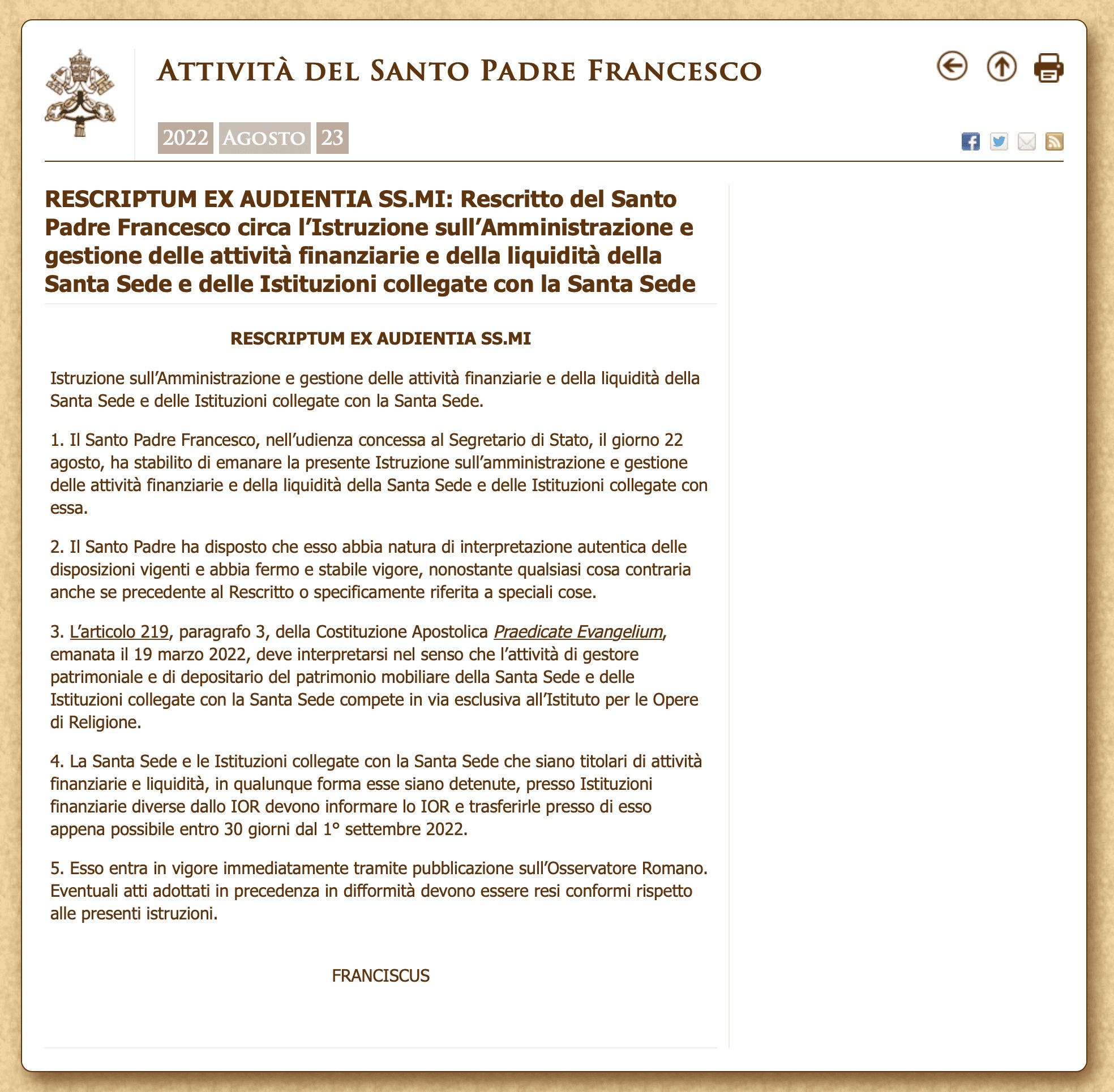

And in case you think the story isn't real, it's confirmed.

ABC News has reported on it here:

Pope Francis on Tuesday imposed an Oct. 1 deadline for all Holy See offices and Vatican-linked institutions to deposit their assets with the Vatican bank.

Francis’ decree follows his decision earlier this year to entrust management of all Vatican assets to one office — the patrimony office known as APSA — in a bid to end decades of mismanagement that culminated with a scandal over a 350 million-euro investment in a London property. Ten people, including former Vatican officials and external brokers, are on trial in the Vatican tribunal on finance-related charges related to the deal.

The Vatican’s economy ministry in July issued a new investment policy requiring all Vatican departments to transfer their assets and investments to APSA via its accounts at the Vatican bank, known as the Institute for Religious Works, or IOR. No specific deadline was given, but the decree published Tuesday says all assets must be transferred by Sept. 30.

The need for a new decree imposing a fixed deadline and stressing there were no exceptions to the regulation suggests some offices or institutions were hoping to keep external accounts or investments.

The Vatican bank has long been mired in scandal but has spent the past decade cleaning up its books and ridding itself of its reputation as an offshore tax haven. Years of reform have slimmed down its client list to Vatican offices, employees, religious congregations and embassies.

And also from the Catholic News Agency:

Pope Francis has ordered that the Holy See and connected entities move all financial assets to the Institute for Works of Religion (IOR), commonly known as the Vatican bank.

The pope’s rescript, issued Aug. 23, clarifies the interpretation of a paragraph in the new constitution of the Roman Curia, Praedicate Evangelium, promulgated in March.

According to Francis’ rescript, financial and liquid assets held in banks other than the IOR must be moved to the Vatican bank within 30 days of Sept. 1, 2022.

The IOR, based in Vatican City State, has 110 employees and 14,519 clients. As of 2021, it looked after 5.2 billion euros ($5.6 billion) of client assets.

Though commonly called a “bank,” the IOR is technically a financial institute, with no branches, working within Vatican City State to provide services to clients, which include the Holy See and connected entities, religious orders, clergy, Catholic institutions, and Holy See employees.

The IOR saw its number of clients decline by 472, from 14,991 clients at the end of 2020 to 14,519 in 2021. Nearly half of its clients in 2019 were religious orders.

According to its annual report, the financial institution’s $19 million net profit in 2021 was also down from $44 million in 2020 and $46 million in 2019.

You can see the actual edict posted on Vatican.va here:

And from our friend Sarah Westall:

Why has Pope Francis ordered all Vatican affiliated entities to transfer ALL FUNDS and assets to the Vatican Bank?

Francis’ rescript specifies that all financial and liquid assets held in banks other than the IOR must be moved to the Vatican bank within 30 days of Sept. 1, 2022.The IOR stands for, Institute for Works of Religion. According to the National Catholic Register the IOR is not a bank, but rather a financial institution:

Though commonly called a “bank,” the IOR is technically a financial institute, with no branches, working within Vatican City State to provide services to clients, which include the Holy See and connected entities, religious orders, clergy, Catholic institutions, and Holy See employees.

The IOR saw its number of clients decline by 472, from 14,991 clients at the end of 2020 to 14,519 in 2021. Nearly half of its clients in 2019 were religious orders.

According to its annual report, the financial institution’s $19 million net profit in 2021 was also down from $44 million in 2020 and $46 million in 2019.

There are multiple reason the Vatican could be ordering all funds to be transferred to the IOR. One reason could be the imminent collapse of the international monetary system that has been predicted by economists for many years now. Jim Rickards, one of the most respected economists in the world, had this to say recently:

Look, I’ve been studying monetary economics for about 50 years. All of my research has led me to one conclusion — we’re going to see the collapse of the international monetary system.

When I say that, I specifically mean a collapse in confidence in paper currencies around the world. It’s not just the death of the dollar or the demise of the euro. It’s a collapse of confidence in all paper currencies.

Over the past century, monetary systems have changed about every 30–40 years on average. Before 1914, the global monetary system was based on the classical gold standard.

Today, the existing monetary system is over 50 years old, so the world is long overdue for a new monetary system.

Others believe the Vatican is being forced to hide their financial records as their involvement in extreme corruption has been getting out to the public. As reported by many independent journalists over the years (although ignored by the mass media), the Vatican has been involved in some of the most horrendous crimes against children possible.

Great analysis over at ThePillar, here's a portion:

The move is interesting on a number of levels.

In the first place, it is a remarkable use of the canonical power of a rescript issued by the pope — to instruct that a text be interpreted in a way that seems hard to reconcile with its plain meaning. The move is so remarkable, in fact, that some canonists have asked if it might be a mistake — a case of the canonical sections of the instruction being published prematurely, or absent necessary legal vetting.

But, assuming Pope Francis means what he has written, there is a more substantial assessment to be offered of the move: that the pope is casting a dramatic vote of confidence in the IOR.

While the bank has been at the center of some of the more lurid financial scandals in recent Vatican history, since 2014, it has been the subject of several financial reforming efforts, with hundreds of accounts closed and charges filed against former officials at the bank.

In January, the former president of the IOR became the first person to be handed a jail sentence by a Vatican City court for financial crimes.

And it was the leadership of the IOR which first flagged as suspicious the Secretariat of State’s London property deal, after Cardinal Parolin pressured the bank to approve a 150 million loan to finance the deal, and the sostituto Archbishop Edgar Peña Parra ordered a retaliatory investigation into the bank’s director for denying the request.

The bank is now widely held to be the most transparent and credible financial institution the Vatican has — in large part because it is subject to international standards and inspections by financial watchdogs.

Crucially, the IOR, as a commercial bank, is the only Vatican financial institution subject to the oversight of the ASIF, the Holy See’s internal financial watchdog, and to Moneyval, the Council of Europe’s anti-money laundering inspectorate.

Although Francis did not provide a rationale for his change on Tuesday, concentrating competence for managing all Holy See investments in the IOR could be aimed at enhancing oversight and regulatory compliance.

The most recent Moneyval assessments have repeatedly singled the IOR out for praise in its reforming efforts, even while warning about its wider concerns about the Vatican, including at ASIF.

During recent hearings in the ongoing Vatican financial trial, former ASIF officials told the judges that they lacked oversight authority of the internal financial affairs at the Secretariat of State and were essentially powerless to intervene in the London deal as it unfolded until the secretariat tried to involve the IOR.

Meanwhile, APSA itself has faced repeated questions about its adherence to both Vatican and international financial norms, and shifting asset management responsibility to the IOR could be, at least in part, a response to those concerns.

While APSA previously provided commercial banking services and accounts to select individuals, like cardinals and members of the papal household, the use of those accounts was linked to allegations of money laundering and other financial crimes, and ending those services was a key priority of financial reforms under Cardinal George Pell, who was appointed by Pope Francis as the first prefect of the Secretariat for the Economy in 2014.

In 2015, the ASIF, concluded that APSA was no longer an “entity that carries out financial activities on a professional basis,” and so was exempted from future ASIF and Moneyval inspections.

Nevertheless, in 2019, the head of APSA, Bishop Nunzio Gallatino acknowledged that APSA had provided a 50 million euro commercial loan to the Secretariat of State in 2014, a violation of its undertakings to ASIF and Moneyval which led to the 2015 exemption. The money went to fund a for-profit enterprise to acquire a Catholic hospital, which had collapsed under 800 million euros of debt related to money laundering, embezzlement, and fraud charges.

Cardinal Parolin later acknowledged that he had acted to secure the loan from APSA, despite a 2012 prohibition on such loans, and when the loan was not repaid, APSA had to write off 30 million euros in bad debt, wiping out its profits for 2018.

In June of this year, APSA partially financed a 100 million euro deal to rescue another scandal hit Catholic hospital in Rome, this time linked businessman Gianluigi Torzi, who is also on trial in the Vatican for extortion, committed a multi-million euro fraud against the hospital.

With the exception of APSA’s real estate management role and the work of Cardinal Kevin Farrell’s commission of reserved financial matters (state secret expenditures, essentially), Pope Francis has apparently now transferred all Holy See asset and investment management activity to the IOR — the only Vatican institution under the oversight of ASIF and Moneyval.

Here's more on the potential upcoming worldwide crash from the one and only Bo Polny...👇

For those who have seen our prior shows, you know that for over a year know, Bo has been talking about September 24, 2022 as a very important date.

He's calculated that date in many different ways, and yesterday he had a brand new insight that once again confirmed the importance of the date.

We discuss that and so much more....including Trump's (soon) return and a coming stock market wipeout (not crash, wipeout).

We also talk how to best prepare for the coming wipeout of the dollar and the soon to come "Biden Bucks".

Yes folks, a changing of our monetary system is not just coming, it's already in the works.

Will you be ready for it?

We talked gold, silver and a spent a LOT of time on cryptocurrencies.

Bo sees a big move coming, and we discussed how you can be ready for it.

I've got the whole interview for you right here on Rumble, please enjoy:

And here are all the links you may be looking for:

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!