I want to preface this by saying something…

The entire system of higher education in America, and the lending practices that surround it, are predatory in every sense of the word.

Those that encourage their children barely 18 years of age, sometimes 17, to take out tens of thousands of dollars, sometimes hundreds of thousands, in debt to receive information they could have found online, for free, is criminal.

It is a failure of the parents, a failure of the teachers, and a failure of every adult worth their salt that has led to the student loan crisis in the first place.

At the end of the day, an individual should be responsible for his or her choices, but this is assuming that the person made a sober choice, under sober circumstances; that they had the faculties to consent to whatever was going on in the first place.

Some of these college-bound kids who take out these loans aren’t even 18 at the time they assume the debt and even if they are, they’re merely 18—they know nothing of the world…

That was presumably the job of the parents and the teachers—to teach the children about the world, to prepare them for all that life has to offer, but instead, the kids are told en masse to mindlessly take out debt and pursue higher education.

Our country has different age of consent laws pertaining to sex and a whole range of issues because we understand that children below a certain age don’t have the faculties or capacities to consent to certain things.

If we agree that they cannot consent to sex, run for office, or make political choices through the ballot, why would we ever agree that they could consent to take on mountains of debt in transactions that they scarcely understand?

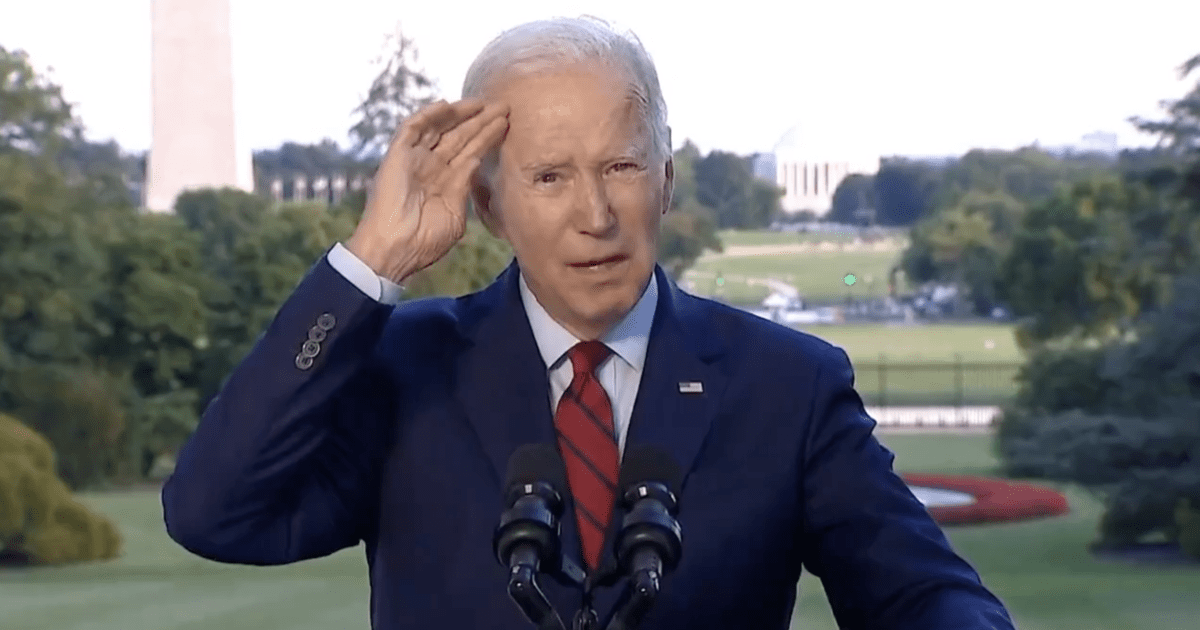

Joe Biden recently announced his plan to forgive student loan debt of up to $10,000 per qualifying individual making less than $125,000 per year.

Honestly, I was tempted to slam Biden’s plan because nothing he does is good nor does it produce positive effects.

I want to champion personal responsibility, but the thing about personal responsibility is that it pertains to consenting adults, and what we have in America today is a complete failure of those adults to provide sound and reasonable financial advice to the kids…

Kids that they are responsible for educating. What high school kid going into college has any financial education? Point one out to me and I’ll eat this article.

In fact, I am hard-pressed to find working, married, adult couples who hold a mortgage and have any real knowledge of finance and money, if they did they likely wouldn’t be holding a 30-year mortgage on personal property in the first place.

In my personal experience, most people don’t even understand that financial education exists; that one can change their entire life and the choices they make by receiving this type of education—I know it changed my life.

Given that this is the landscape in America, who is truly to blame for the student loan crisis? Poorly informed children? Or the adults that should have known better, but engaged in a complete betrayal of those children by passing down the buck?

Does this mean I agree with Biden’s plan? Not necessarily, in an ideal world, these loans and predatory lending practices simply wouldn’t exist, but we don’t live in an ideal world.

I am hesitant, at best, to support any sort of government plan for anything. Who knows, student debt forgiveness may worsen the problem by sending the message that it’s ok to take out these debts—they never have to be settled anyway, so why not?

I am also aware of the issue that much of this debt is related to graduate degree programs—not simple 4-year degrees and that many of these programs are utterly worthless in terms of real-world value.

Still, something has to change, and it has to change in a major way—not just reactionist government policy to a social and cultural problem that permeates practically every household in our society…

Teach your children well, as the old song goes…

Here’s more on the story:

In keeping with my campaign promise, my Administration is announcing a plan to give working and middle class families breathing room as they prepare to resume federal student loan payments in January 2023.

I'll have more details this afternoon. pic.twitter.com/kuZNqoMe4I

— President Biden (@POTUS) August 24, 2022

Here are some facts: Only 37% of Americans have a 4-yr college degree, only 13% have graduate degrees, and a full 56% of student loan debt is held by people who went to grad school.

Biden's plan to cancel it would be like taking money from a plumber to pay the debt of a lawyer.

— Greg Price (@greg_price11) August 23, 2022

The Hill confirmed:

Borrowers who earn less than $125,000 a year, or families earning less than $250,000, would be eligible for the $10,000 loan forgiveness, Biden announced in a tweet.

For recipients of Pell Grants, which are reserved for undergraduates with the most significant financial need, the federal government would cancel up to an additional $10,000 in federal loan debt.

The solution to the student debt crisis is simple:

Let people who can't pay their student loans have it discharged in bankruptcy court.

That would force lenders to be less predatory in their lending practices.

Guess who made that nearly impossible.https://t.co/Vw144u6ioR

— Spike Cohen (@RealSpikeCohen) August 24, 2022

NEW: As Biden weighs a student debt decision, Penn Wharton Budget Model has released its analysis of student loan forgiveness, estimating it will cost bet. $300-$980 billion, w/majority of relief going toward borrowers in top 60% of earners. More on the @TheTerminal.

— Nancy Cook (@nancook) August 23, 2022

Fox News provided some stats on the issue:

The nation’s federal student debt now tops $1.6 trillion after ballooning for years.

More than 43 million Americans have federal student debt, with almost a third owing less than $10,000 and more than half owing less than $20,000, according to the latest federal data.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!