Anyone with common sense will realize the Biden Administration is destroying the United States from within.

There’s no way the regime can be THIS incompetent by accident.

- Record-high gas prices

- Soaring inflation

- Weakening the military

- Demoralization of society

- Physically and psychologically harming children

It’s all by design, and sadly, many Americans can’t see the federal government destroying their country before their eyes.

While America is internally decimated, a new alliance prepares to carry the world into a globalized economy.

Trending: Mike Lindell: “It’s Over” — Tells Steve Bannon He Finally Has All The Evidence He’s Been Waiting On!

BRICS, led by Brazil, Russia, India, China, and South Africa, has announced plans to launch a new global reserve currency.

If the Biden Administration successfully destroys the United States from within, the BRICS global reserve currency would likely replace the US dollar.

Look up Brics. Everyone needs to see this..https://t.co/DJu8Xm0cIu

— sherry loves America🍊freedom 🍊 (@sherry2diamond) June 29, 2022

"… the issue of creating a reserve currency based on the BRICS currency basket is being worked out, Putin said on Tuesday in a greeting to the participants of the organization’s business forum."https://t.co/wUoSAGG7v1

— Thorsten Polleit (@ThorstenPolleit) June 22, 2022

https://twitter.com/wakoppa/status/1542202378690117637

From Markets Insider:

Russia is ready to develop a new global reserve currency alongside China and other BRICS nations, in a potential challenge to the dominance of the US dollar.

President Vladimir Putin signaled the new reserve currency would be based on a basket of currencies from the group’s members: Brazil, Russia, India, China, and South Africa.

“The matter of creating the international reserve currency based on the basket of currencies of our countries is under review,” Putin told the BRICS Business Forum on Wednesday, according to a TASS report. “We are ready to openly work with all fair partners.”

The dollar has long been seen as the world’s reserve currency, but its dominance in share of international currency reserves is waning. Central banks are looking to diversify their holdings into currencies like the yuan, as well as into non-traditional areas like the the Swedish krona and the South Korean won, according to the International Monetary Fund.

As UnHerd noted, other nations are jumping on the BRICS bandwagon to escape Western-led globalization.

This week it was announced that Iran and Argentina had applied to join the BRICS.

UnHerd explained:

It is difficult not to read the two stories as part of the same general arc. Iran and Argentina are jumping on the bandwagon because they sense an opportunity to build an alternative alliance to Western-led globalisation. Meanwhile, the other BRICS members are inviting them on board because they smell blood because they see large economic weaknesses being exposed by the quick collapse of the Western sanctions against Russia.

Could a new trade bloc with its own reserve currency be a threat to the West and to US dollar dominance? Almost certainly. In their current form the BRICS make up around 31.5% of world GDP when adjusted on a purchasing power parity basis. With Iran and Argentina added, this rises to 33% of world GDP. This is a huge potential trade bloc, and 33% of global GDP is certainly enough to justify a reserve currency.But beyond this, the potential for synergies between the countries is enormous. Taken together, the expanded BRICS countries currently produce around 26% of global oil output and 50% of iron ore production used to make steel. They produce around 40% of global corn production and 46% of global wheat production. If these were all traded in the new reserve currency, it would instantly become a cornerstone of the world economy.

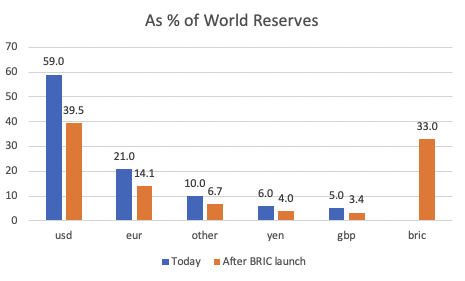

Meanwhile, the US dollar is already sagging. At the beginning of June, the IMF released a report showing that the US dollar today makes up 59% of global reserves — a far cry from the 70% it made up in 1999. The report noted that central bank reserve managers were actively shifting their portfolios away from dollars and into non-traditional currencies.

Now imagine what that would look that if the BRICS launched its reserve currency — let’s call it the ‘BRIC’. Assume that the BRIC was held as a reserve roughly in line with the bloc’s importance in terms of global GDP and that it took a bite out of all other reserve holdings equally. The impact would look something like the chart below. As we can see, even this simple exercise shows that the BRIC would easily hold its own against the US dollar.

Greg Reese from Infowars provides further information about BRICS in this Rumble video:

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!