“Governor Ron DeSantis signed House Bill 7071 which provides more than $1.2 billion of tax relief for Floridians,” a press release stated.

“Florida’s economy has consistently outpaced the nation, but we are still fighting against inflationary policies imposed on us by the Biden administration,” said Governor Ron DeSantis. “In Florida, we are going to support our residents and help them afford the goods that they need. Florida has been fiscally responsible, so we are in a good position to provide meaningful relief for families, right now.”

“The Florida House’s tax package — the largest middle-class tax relief package in the history of the state — is now the law of the land,” said Speaker Chris Sprowls. “A bill like this has never been more needed than it is right now. Reckless federal spending sent inflation rates spiraling higher than we’ve seen in generations, and Floridians are feeling the impacts. From tools to diapers to books for summer reading, this billion-dollar tax package includes something for every Floridian, and that’s what I’m most proud of. Thank you to Chair Bobby Payne, the Ways and Means Committee, and to Senate President Simpson and our Senate counterparts for your leadership and commitment to keeping money in the pockets of hard-working Floridians.”

TALLAHASSEE, Fla. — From gas to diapers to hurricane supplies, dozens of expensive and essential items will be tax-free in Florida over the next few months after Gov. Ron DeSantis signs 'largest tax relief in the history of the state'

— Election Wizard (@ElectionWiz) May 7, 2022

The legislation I signed today will provide Floridians more than $1.2 billion in tax relief on gas, diapers, school supplies, tools for skilled trades, event tickets and much more.

This robust tax relief package is one of the ways Florida is fighting back against Bidenflation. pic.twitter.com/BLI965wqCJ

— Ron DeSantis (@GovRonDeSantis) May 6, 2022

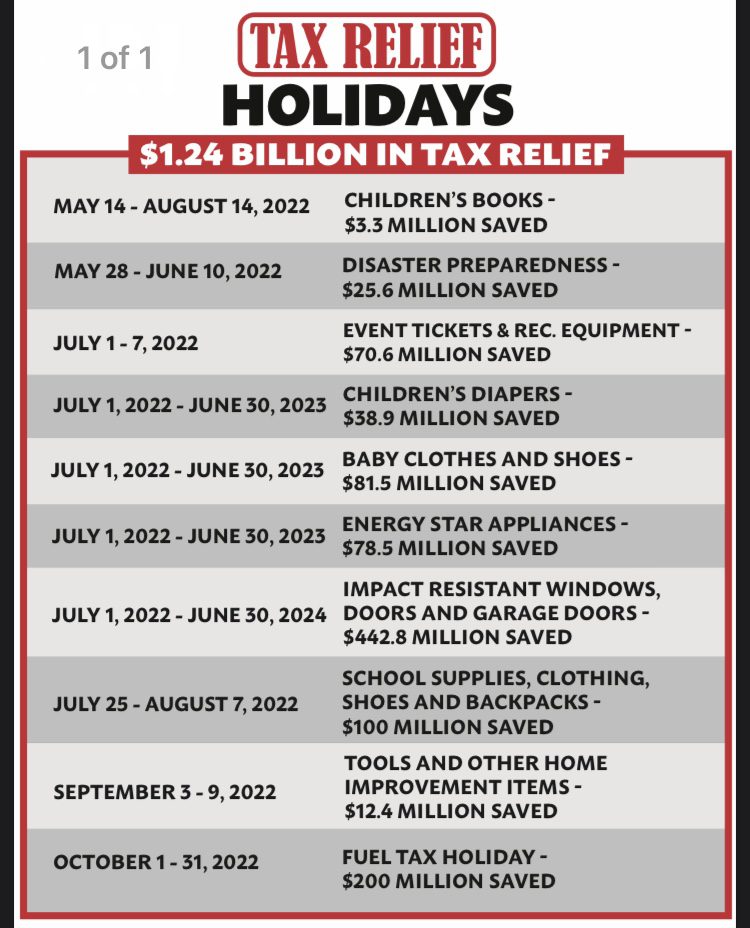

The 10 tax holidays are:

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!