BioNTech is a German biotechnology company based in Mainz that develops and manufactures active immunotherapies for patient-specific approaches to the treatment of diseases.

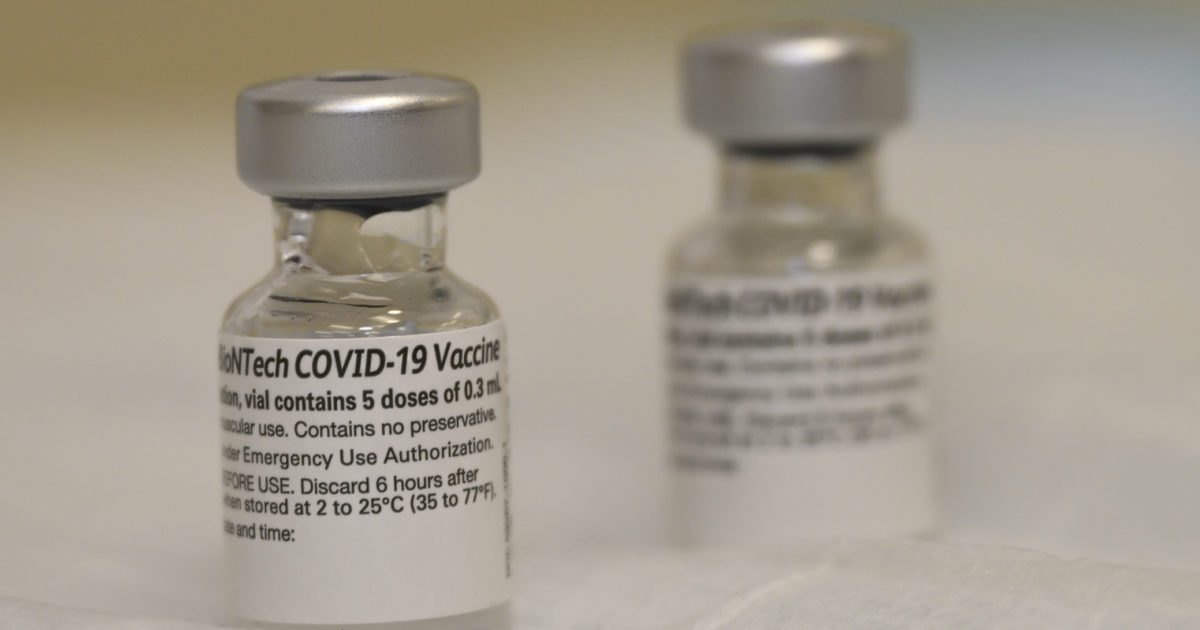

The company formed a partnership with Pfizer in 2020 to develop an experimental COVID-19 mRNA injection.

Pfizer explains their partnership:

- Pfizer and BioNTech to jointly develop COVID-19 vaccine, initially in the United States and Europe, and scale-up manufacturing capacity to support global supply

- Potential to supply millions of vaccine doses by the end of 2020 subject to technical success of the development program and approval by regulatory authorities, and then rapidly scale up capacity to produce hundreds of millions of doses in 2021.

- BioNTech will contribute multiple mRNA vaccine candidates as part of its BNT162 COVID-19 vaccine program, which are expected to enter human testing in April 2020

- Pfizer will contribute its leading global vaccine clinical research and development, regulatory, manufacturing and distribution infrastructure and capabilities

- BioNTech will receive an upfront payment of $185 million, including an equity investment of approximately $113 million, and be eligible to receive future milestone payments of up to $563 million for a potential total consideration of $748 million

Coincidentally, Mr. Bill Gates made some investments in the German biotech company:

Trending: Mike Lindell: “It’s Over” — Tells Steve Bannon He Finally Has All The Evidence He’s Been Waiting On!

German Bild newspaper:

„US Study: Corona escaped lab in Aug 2019“German Ministry for Education and R&D on the 5th of Sept 2019:

„Bill Gates invests in Mainz“

(Reference to Biontech‘s HQ)Now that is what I‘d call a coincidence!! pic.twitter.com/38M2T9JnpV

— peripheralthings (@greentardscycle) August 14, 2021

https://twitter.com/JensBehnkeDE/status/1455489777525051392

https://twitter.com/supergranlinz/status/1444924013323722755

From Business Wire:

BioNTech SE, a clinical-stage biotechnology company focused on patient-specific immunotherapies for the treatment of cancer and other serious diseases, announced today that it has signed an agreement with the Bill & Melinda Gates Foundation (the Gates Foundation) to develop HIV and tuberculosis programs, further expanding the Company’s infectious disease portfolio. This partnership includes an initial equity investment of $55 million, which is expected to close within the next week. The funds will be used to develop preclinical vaccine and immunotherapy candidates to prevent HIV and tuberculosis infection as well as to lead to durable antiretroviral therapy-free remission of HIV disease. Total funding under the collaboration could reach $100 million through potential future grant funding from the Gates Foundation that would be used to underwrite the evaluation of these candidates in the clinic and support the initiation of new infectious disease projects.

“We are thrilled about the partnership with the Gates Foundation and the outstanding network of infectious disease specialists that it has built,” said Prof. Ugur Sahin, CEO of BioNTech. “Targeting severe infectious diseases such as tuberculosis and HIV infection is in line with our mission to leverage our immunotherapy capabilities not only for cancer but also beyond, in disease areas of high medical need.”

“Despite remarkable advances in global health since 1990, current approaches to preventing and treating tuberculosis – the world’s leading cause of death from infectious disease – and HIV infection remain inadequate,” said Lynda Stuart, Deputy Director, Vaccines and Human Immunobiology, Discovery and Translational Sciences at the Gates Foundation. “BioNTech’s innovative mRNA-based approach and in-depth understanding of the immune system offer exciting pathways to develop effective new immune-based therapies that could dramatically reduce the global incidence of HIV and tuberculosis. We believe this partnership will add to our portfolio of innovative tools and could make a significant impact.”

With their mRNA-based approach and immune-based therapies, BioNTech hoped to revolutionize “vaccines” with the funding.

And from the looks of it, the COVID-19 “pandemic” helped enrich BioNTech and bring Gates a hefty return on his investment.

In September of 2019, Bill Gates spent $55MM on a pre-ipo equity investment into BioNtech, which later partnered with Pfizer to make its mRNA vax.

That Gates investment is now worth over $550 million dollars.

No further questions, plebs!

— Jordan Schachtel @ dossier.today (@JordanSchachtel) April 29, 2021

Bill Gates invested $55 million in BioNTech (The company that partnered with Pfizer to create their mRNA Covid-19 vaccine) on Sep 4th, 2019… two months before SARS CoV-2 was identified. 🤔 I'm sure the timing (& partnership with Pfizer) is totally coincidental though. *SARCASM*

— Stefan Antonino 🎸🎶 🇺🇲 (@StefanAntonino) September 8, 2021

What a coincidence?

But digging through past BioNTech reports reveals the company expressed serious doubts about their mRNA technology.

As late as 2019, they didn’t think the technology would earn approval.

In September 2019, BioNTech submitted their SEC filing and stated their mRNA immunotherapies have substantial risks, may not be effective, could cause harm, and earn the classification of gene therapy.

Check out the reports:

https://twitter.com/supergranlinz/status/1459222033074724864

Before Covid & ever changing definitions of a "vaccine", BioNTech didn't think that mRNA technology would ever be approved.

A direct quote from the BioNTech Annual Report in 2019, page 8.

If legit, are any experts or reliable sources discussing the company's own concerns? https://t.co/YEEWphTVnv

— Dee Doherty 💜 (@Deedoherty2) November 13, 2021

https://twitter.com/5Djindji/status/1458893041499058176

Human Guinea Pig Project started in 2020.

In 2019 Biontech was pessimistic regarding mRNA immunotherapies: https://t.co/qjKuYCwXx7 pic.twitter.com/mRHynpFTEq

— 𝐌𝐨𝐭𝐜𝐨 𝐅𝐞𝐝𝐞𝐬 (@DrFedes) November 13, 2021

Let’s make note of BioNTech’s success prior to COVID-19 in the SEC filing:

We are a clinical-stage biopharmaceutical company with no pharmaceutical products approved for commercial sale. We have incurred significant losses since our inception and we anticipate that we will continue to incur significant losses for the foreseeable future, which makes it difficult to assess our future viability.

We have incurred net losses in each year since our inception in 2008, including net losses of €179.2 million and €48.3 million for the years ended December 31, 2019 and December 31, 2018, respectively. As of December 31, 2019, we had accumulated losses of €424.8 million (€245.8 million as of December 31, 2018).

We have devoted most of our financial resources to research and development, including our clinical and preclinical development activities and the development of our platforms. To date, we have financed our operations primarily through the sale of equity securities and proceeds from collaborations and, to a lesser extent, through revenue from manufacturing operations and grants from governmental and private organizations. The amount of our future net losses will depend, in part, on the rate of our future expenditures and our ability to obtain funding through equity or debt financings, sales of assets, collaborations or grants. We have not commenced or completed pivotal clinical trials for our programs and it will be several years, if ever, before we or our collaborators have a product candidate ready for commercialization. Even if we obtain regulatory approval to market a product candidate, our future revenues will depend upon the size of any markets in which our product candidates have received approval, and our ability to achieve sufficient market acceptance, reimbursement from third-party payors, and adequate market share in those markets. We may never achieve profitability.

I guess that investment from Gates came in handy to help their profitability.

You’ll find this intriguing quote on page 15:

No mRNA immunotherapy has been approved, and none may ever be approved. mRNA drug development has substantial clinical development and regulatory risks due to the novel and unprecedented nature of this new category of therapeutics.

Remember how Big Tech censors you for calling the COVID-19 mRNA injections a “gene therapy?”

From page 16:

Currently, mRNA is considered a gene therapy product by the FDA. Unlike certain gene therapies that irreversibly alter cell DNA and may cause certain side effects, mRNA-based medicines are designed not to irreversibly change cell DNA. Side effects observed in other gene therapies, however, could negatively impact the perception of immunotherapies despite the differences in mechanism. In addition, because no mRNA-based product has been approved, the regulatory pathway in the United States and may other jurisdictions for approval is uncertain. The pathway for an individualized therapy, such as our iNeST mRNA-based immunotherapy where each patient receives a different combination of mRNAs, remains particularly unsettled. The number and design of the clinical and preclinical studies required for the approval of these types of medicines have not been established, may be different from those required for gene therapy products or therapies that are not individualized or may require safety testing like gene therapy products. Moreover, the length of time necessary to complete clinical trials and submit an application for marketing approval by a regulatory authority varies significantly from one pharmaceutical product to the next and may be difficult to predict.

Our product candidates may not work as intended, may cause undesirable side effects or may have other properties that could delay or prevent their regulatory approval, limit the commercial profile of an approved label, or result in significant negative consequences following marketing approval, if any.

From this report, it’s obvious BioNTech expressed lots of concern about their mRNA immunotherapies.

However, things took a dramatic turn due to COVID-19.

Yep, sort of makes you wonder what changed (in the mrna tech) since they reported these findings in 2019.

Some highlights from biontech's 2020 annual report below https://t.co/NkemFbrsJ6 pic.twitter.com/IE5VrJkVdL— foust – headlight on a northbound train (@jephfoust) November 13, 2021

From the BioNTech 2020 annual report:

Our revenue depends heavily on sales of our COVID-19 vaccine, and our future revenues from our COVID-19 vaccine are uncertain. Our COVID-19 vaccine was granted emergency use authorization in the United States and the United Kingdom, and conditional marketing approval in the European Union, in December 2020, followed by emergency or

limited use authorization in a number of other countries and approval for use in certain other countries. Prior to this, we had not sold or marketed any products in our pipeline. As a result, we expect that a majority of our total revenues, and all of our product revenues, in 2021 will be attributable to sales of our COVID-19 vaccine. There is intense competition in the field of COVID-19 vaccines, including with other vaccines that have been authorized for emergency use and those in late-stage clinical development. Our future revenues from sales of our COVID-19 vaccine depend on numerous factors

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!