Folks, there is a reason I keep sounding the alarm about silver.

Because I am a reporter and when it looks like something big is happening, I report it!

Earlier today, I brought you this interview

Watch safely here on Rumble:

👉 Download Bo’s slides here:

https://drive.google.com/file/d/1t7nfRl8a3lrzvD78Fi9-yAKHBeAhcfLG/view👉 If you want Bo’s trading Newsletter, go to https://www.gold2020forecast.com/cryptocurrency-index, use code NOAH49.

There was one line he said about silver where I actually got out my pen and wrote down the quote as we were talking:

If you’re waiting to buy silver, you probably won’t be able to get it when you finally get around to buying. The price will be irrelevant.

Well, no sooner did I publish that interview with Bo telling you silver is about to go vertical, then I see this:

https://twitter.com/WallStreetSLVR/status/1371818990184587265?s=20

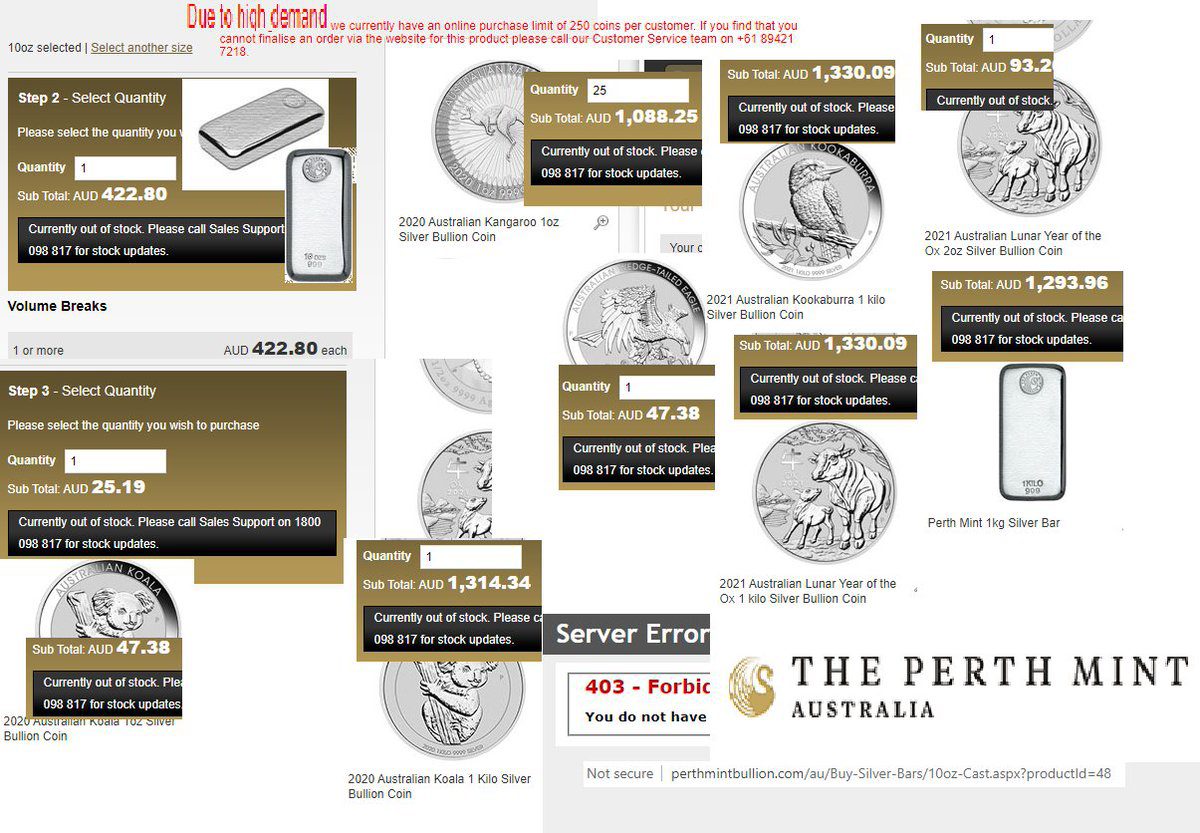

Here’s a zoom in to see that better:

Uhhhhh yeah, the Perth Mint is kind of a big deal!

Are they out of silver?

You don’t have to be Alan Greenspan to understand basic supply and demand like this….

When there is no supply left, prices go rocket ship.

I learned that in ECON101.

It’s not just Twitter reporting on the story.

Is Reuters a good enough source for you?

A retail investment frenzy in silver driven by social media has left dealers from the United States to Singapore scrambling for bars and coins to meet demand.

Silver prices extended their rally on Monday to an eight-year high as small investors answered calls on social media last week to buy the metal to push up prices. Retail investors cannot directly access the wholesale silver market, so instead they have bought into bars and coins. [GOL/]

“There are massive shortages. We’ll be completely out of stock if it carries on like this – the first time since our company opened in Singapore seven years ago,” said David Mitchell, managing director at Indigo Precious Metals.

Some customers sold gold to buy silver, said Gregor Gregersen, founder of Silver Bullion Pte Ltd, another dealer in Singapore.

“There’s a definite shortage of popular silver coins developing (especially North American coins),” he said. “However, we’re still able to source 1,000 oz good delivery bars at nearly the same premiums for now.”

U.S. bullion broker Apmex warned of delays in processing silver transactions because of surging volumes.

Other U.S. dealers, including JM Bullion and SD Bullion, warned customers of shipping delays of five to 10 days. Everett Millman at Gainesville Coins in Florida said they were expecting shipping delays, perhaps until perhaps mid-March, for some products like Silver Eagles and Silver Maples.

While a rapid spike in demand has tightened supplies, there is plenty of metal around and delays should ease once metal can be shipped to where it is needed, dealers and industry experts said.

Kevin Rich, global gold market adviser for Australia’s Perth Mint, said that while dealers of coins and bars might see some supply constraints and therefore charge higher premiums on these products, the Mint does not anticipate any such issues.

There is enough airline traffic to ensure supply can move around, he said, unlike last year when the lack of freight capacity disrupted gold markets.

“In the short term, stocks may run out since it takes a long time for sea shipping, but overall supply is ample,” said Peter Fung, head of dealing at Hong Kong-based Wing Fung Precious Metals.

Around 1 billion ounces of silver are produced and consumed each year, and supply has been in surplus for most of the last decade, consultants Metals Focus said.

My friends over at DISME still have some silver Trump coins left, although even they have many sold out and no longer available.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!