Could a 0% payroll tax rate become a reality?

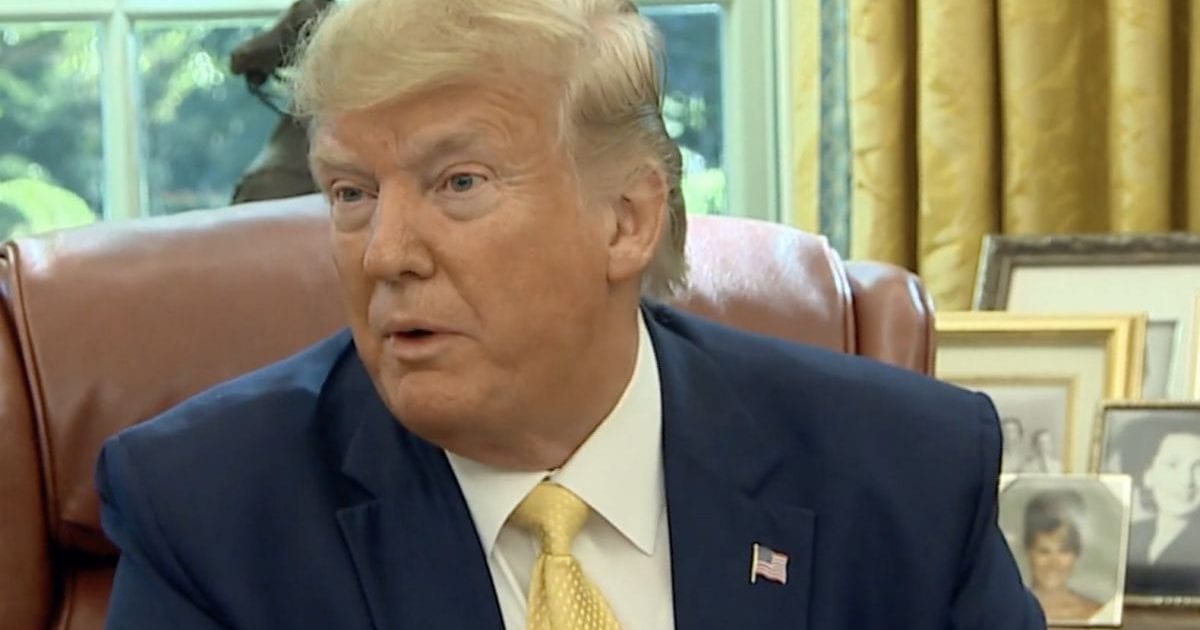

Trump has reportedly pitched the idea to Republican lawmakers as fears over the coronavirus shake investors on Wall Street.

The idea was to cut payroll taxes to 0% through the end of the year, though the idea of making the cut permanent was also discussed according to those at the meeting.

Whether or not the President’s pitch gains any traction, it proves one thing for certain: Trump continues to act like a Washington-outsider, unafraid to shake up the status quo!

If this passes, it would certainly be a historic moment and a brave act of leadership to protect American workers and jobs as the coronavirus unfolds.

More details below:

While the economy as a whole remains extremely strong and vibrant, the uncertainty around the coronavirus has rattled investors.

This uncertainty has caused the stock market to become more volatile in recent days.

As the administration moves to slow down and eventually stop the virus itself, the president is also focusing on protecting the economy for American workers.

CNBC has more details on the proposed 0% payroll tax break:

President Donald Trump, in a meeting with Republican lawmakers on Capitol Hill Tuesday, pitched a 0% payroll tax rate that would last through the rest of this year, a White House official told CNBC.

There was also discussion of making the payroll tax rollback permanent, said the official, who declined to be named.

The development comes as Trump and the White House try to put together an economic stimulus plan to counteract the impact from the widening coronavirus outbreak. After a 2,000-point drop on the Dow Jones Industrial Average on Monday, the Dow bounced back somewhat Tuesday, rising more than 900 points late in the trading session.

Earlier Tuesday, CNBC reported that the White House was not ready to roll out a specific plan of action on the economy while the deadly coronavirus spreads. Trump stunned people in the White House on Monday, according to officials, when he said that he would announce economic policy proposals in a press conference Tuesday.

A press briefing with the White House coronavirus task force is slated for 5:30 p.m. Tuesday, according to Trump’s official schedule. The White House has also invited Wall Street executives to a meeting Wednesday to discuss an economic response to the coronavirus’ impact.

Trump, who faces a bitter reelection fight this year, mentioned the possibility of a payroll tax cut Monday evening. He has said he wants to help out the airline and cruise industries, as well, while fear of the virus and travel restrictions have crushed demand for tourism and business travel.

While some Republicans are skeptical, the idea is still being discussed on Capitol Hill.

There are still many things we don't know about the novel coronavirus.

Because it's new, we don't know if it will naturally dissipate in the summer months, similar to the flu -- or if transmission will still continue throughout the year.

Washington is trying to figure out every possible way to mitigate the impact of the virus: both in terms of public health and the U.S. economy.

That is why the 0% payroll tax rate pitched by President Trump is being discussed.

So what exactly are payroll taxes?

CNN has more details on how a payroll tax cut could potentially work:

The payroll tax supports the country's two biggest safety nets: Social Security and Medicare.

Workers will pay 6.2% on the first $137,700 of their wage and salary income into Social Security this year. And they will pay 1.45% of all their earned income for Medicare. Their employers will match those amounts. If they're self employed, they pay both the worker and employer shares, but get to deduct the latter.

How would a payroll tax cut work?

No one has proposed any specifics yet. But typically a payroll tax cut applies to the 6.2% tax that goes into Social Security.

And if lawmakers do approve one, it most likely would be in effect for a limited period of time.

In a tweet earlier this morning, CNBC suggested that the stock market rally today is due in part to Trump's proposal.

See below:

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!