As WeLoveTrump noted, the Federal Reserve and Treasury Department caved amidst the Silicon Valley Bank collapse.

In an unprecedented Sunday night decision, they released a joint statement saying they will make all depositors whole — regardless of the $250,000 normal FDIC limit.

After saying earlier that bailouts were off the table, we’re suddenly right back to 2008 again and protecting the rich and the “too big to fail."

Per reports, Chinese and Israeli tech start-ups that relied on capital from Silicon Valley Bank were among the groups in a panic and hoping for a bailout to protect their deposits.

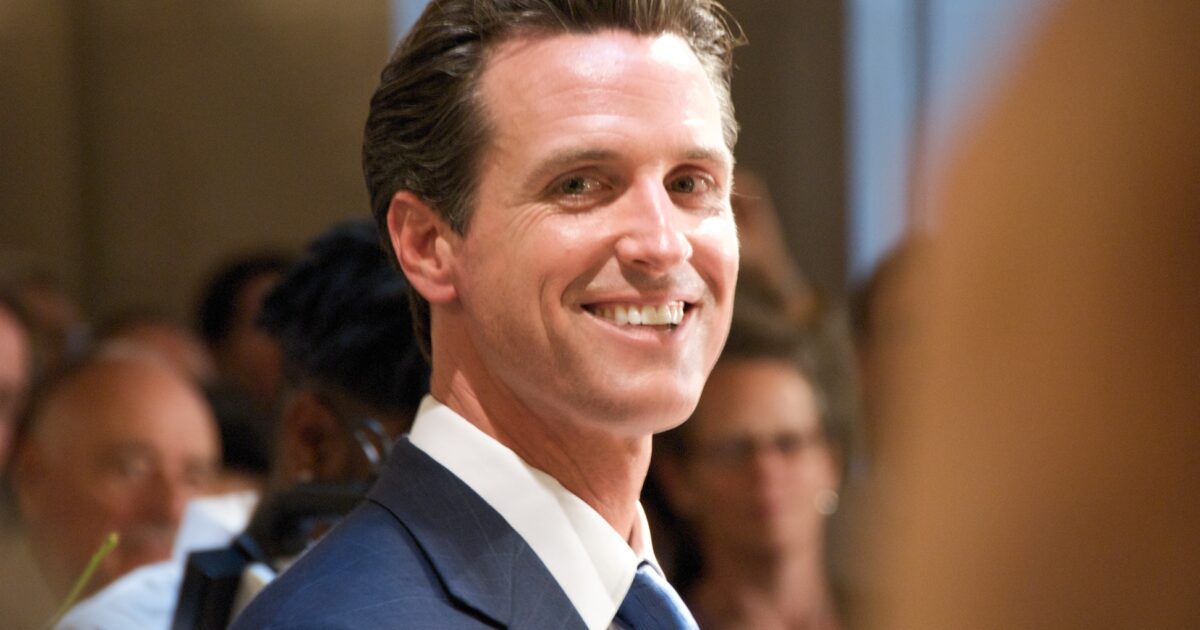

California Gov. Gavin Newsom is one individual reportedly with personal ties to Silicon Valley Bank and hoping for a bailout.

According to reports, Newsom lobbied the White House and Treasury for a Silicon Valley Bank bailout.

However, the Democrat governor reportedly didn't disclose his personal accounts at the bank.

"California law bans officials from influencing decisions in which they have 'a financial interest,'" Business Insider states.

https://twitter.com/officer_Lew/status/1635737409370431489

Cheering Silicon Valley Bank Bailout, Gavin Newsom Doesn’t Mention He’s a Client https://t.co/u3bz9q3zGX by @kenklippenstein

— The Intercept (@theintercept) March 14, 2023

Gavin Newsom issued this statement regarding Silicon Valley Bank Sunday:

Governor Gavin Newsom today issued the following statement in response to the Biden Administration’s announcement enabling the Federal Deposit Insurance Corporation to complete its resolution of Silicon Valley Bank in a manner that fully protects all depositors.

“The Biden Administration has acted swiftly and decisively to protect the American economy and strengthen public confidence in our banking system. Their actions this weekend have calmed nerves, and had profoundly positive impacts on California — on our small businesses that can now make payroll, workers who will get their paychecks, on affordable housing projects that can continue construction, and on non-profits that can keep their doors open tomorrow. California is a pillar of the American economy, and federal leaders did the right thing, ensuring our innovation economy can continue to grow and move forward.”

According to The Intercept, at least three wineries owned by Newsom are Silicon Valley Bank clients, and a "bank president sits on the board of his wife’s charity."

Further details from The Intercept:

CADE, Odette, and PlumpJack, three wineries owned by Newsom, are listed as clients of SVB on the bank’s website. Newsom also maintained personal accounts at SVB for years, according to a longtime former employee of Newsom’s who handled his finances, and who requested anonymity to avoid professional reprisal.

“Governor Newsom’s business and financial holdings are held and managed by a blind trust, as they have been since he was first elected governor in 2018,” Nathan Click, a spokesperson for Newsom, told The Intercept in an email.

Newsom also didn’t mention his wife Jennifer Siebel’s professional ties to the bank. In 2021, Silicon Valley Bank gave $100,000 to the charity founded by Siebel, the California Partners Project, at the request of Newsom. John China, president of SVB Capital and responsible for SVB’s funds management, is himself a founding member of the California Partners Project’s board of directors.

Newsom added on Monday that he had been in close contact with the administration about SVB. “Over the last 48 hours, I have been in touch with the highest levels of leadership at the White House and Treasury,” Newsom said of SVB’s collapse in a statement released on Saturday. Asked about the nature of the interactions, the governor’s deputy communications director Brandon Richards did not respond.

Silicon Valley Bank Ties to California First Partner Jennifer Newsomhttps://t.co/aN6etdRnUr

— Robert W Malone, MD (@RWMaloneMD) March 12, 2023

Now @GavinNewsom please admit you just realized that 1% of Californias pay most of the taxes you collect. And much of that 1% was in SVB. No SVB, no tax. How will you send “gas rebate,” I mean “inflation relief” checks to people just before an election?

— Houman David Hemmati, MD, PhD (@houmanhemmati) March 11, 2023

. @GavinNewsom should be transparent about California’s First Lady’s relationship to the SVB leadership.

Did she get involved at all? What did they say to her in the lead up to the collapse? https://t.co/iDMdkr2SNW

— Richard Grenell (@RichardGrenell) March 12, 2023

California Globe reported on Grenell's comments:

The Globe reached out to Grenell for a comment:

“Gavin has always been a secretive politician,” Grenell said. “He never gives the full story and the Sacramento media is largely afraid to take him on. The lack of transparency in State government is a dangerous situation because California is currently a one party controlled dictatorship and Gavin is the boss.”

Grenell fairly asks, “@GavinNewsomshould be transparent about California’s First Lady’s relationship to the SVB leadership. Did she get involved at all? What did they say to her in the lead up to the collapse?”

Indeed. As Forbes notes, this meltdown did not happen overnight. “Silicon Valley Bank Proxy Shows Board’s Secret Yearlong Risk Panic,” the Forbes headline says. “The sudden freefall is likely not a surprise to the SVB board. In the past 15 months, as top insiders cashed options and sold shares, SVB operated without a full-time chief risk officer and the number of board risk committee meetings more than doubled.”

Notably, Silicon Valley Bank had no official chief risk officer for 8 months while the Venture Capital market was spiraling, Fortune reported. “It is unclear how the bank managed risks in the interim period between the departure of one CRO and appointment of another.”

Business Insider noted the potential ramifications of these reports:

It is unclear whether those personal accounts were still active at the time of the bank's collapse last week. If they were, Newsom could have stood to benefit directly from the Biden administration's rescue package, which will reimburse SVB account holders even if their balances surpass the $250,000 limit insured by Federal Deposit Insurance Corporation.

cont.

Newsom has not discussed his personal ties to SVB publicly. It is unclear whether he disclosed them to the White House or Treasury during his contacts with the administration over the weekend.

As an elected official, Newsom is prohibited by state law from influencing a governmental decision "in which the official knows or has reason to believe the official has a financial interest."

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!