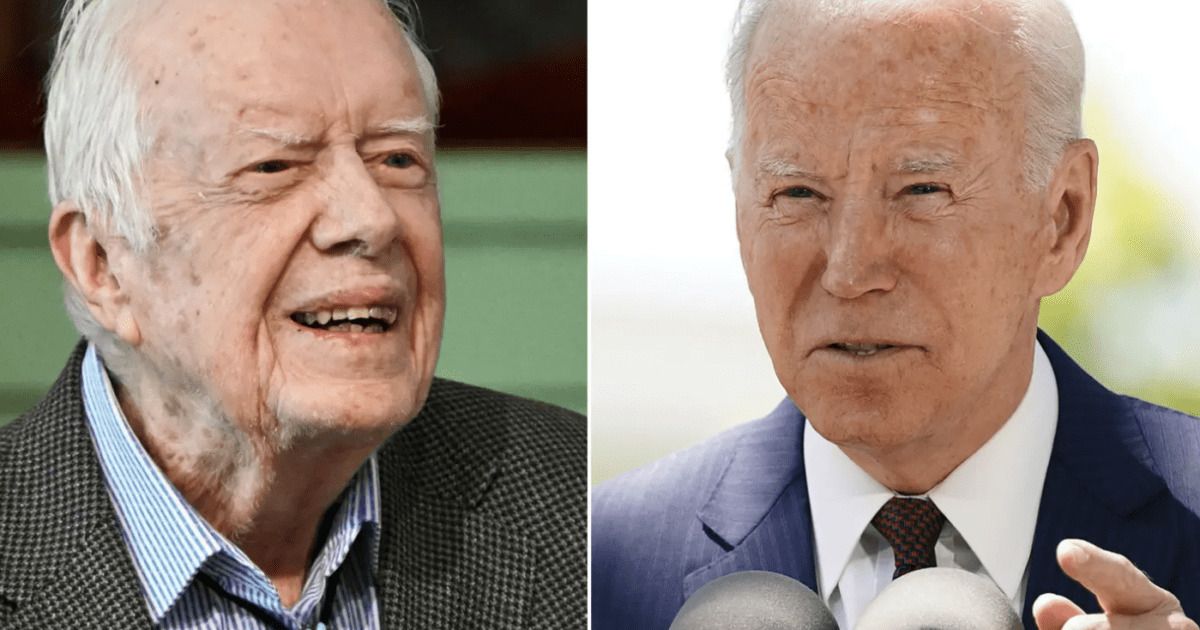

The US is headed towards 1970’s inflation according to Harvard economist, Larry Summers. He sees many parallels between our economy now and the economy that tanked under Carter’s administration. If those factors hold true, Summers thinks stagflation and a major recession are on the way.

Stagflation happens when the economy suffers high inflation, high unemployment, and slow or negative economic growth. Basically, as prices soar, people pull back on spending, which causes businesses to layoff employees.

Summer’s makes an apples to apples comparison between how inflation was calculated in the 70’s and today. If you do the math the same, inflation in the 1970’s would be adjusted to 10%, which is much closer to today’s 8.5%.

Here’s Summers take on Bloomber’s “Wall Street Week”:

In an earlier opinion piece published by the Washington Post, Summers concluded the stagflation will lead to a major recession:

The Fed’s current policy trajectory is likely to lead to stagflation, with average unemployment and inflation both averaging over 5 percent over the next few years- and ultimately to a major recession.

Summers is a progressive, but even he could see the dangers in Biden’s $1.9 trillion covid-relief proposal last year. In February 2021, Summers authored a column where he wrote:

There is a chance that macroeconomic stimulus on a scale closer to World War II levels than normal recession levels will set off inflationary pressures of a kind we have not seen in a generation.

Summers was not alone. Even earlier, economists were sounding the alarm that money supply policies were going to create major problems with stagflation when the economy reopened after covid shutdowns.

Fed's balance sheet is soaring.

Meanwhile, money supply (M1 and M2) are also rising significantly in the middle of a lockdown.

Demand-side inflationary policies do not work in a forced shutdown, and may lead to a larger problem (deflation then staglation) when the economy opens pic.twitter.com/U0JxIaEjnE

— Daniel Lacalle (@dlacalle_IA) May 16, 2020

The Counsel on Foreign Relations (“CFR”) thinks fears over stagflation are overblown:

The Federal Reserve and the global economy are confronting major challenges, only exacerbated by the response to the Russian invasion of Ukraine. Given the similarities and differences between the 1965-1982 period and now, the recent fear of stagflation is legitimate, but seems overstated. The Fed, the economics profession, and the population in general have all learned much from that experience of the 1960s and 1970s and the painful recession that it took to eradicate inflationary pressures that had built over many years. Even the challenges that are like those we faced in the earlier episode of stagflation—oil market dynamics—are not as severe.

Trust the Fed? I don’t think so. The CFR’s opinion is in the minority. According to recent poll, 81% of adults in America this our economy on track for a recession this year.

If there’s a silver lining within the 1970s comparison it’s that Reagan was elected after Carter.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!