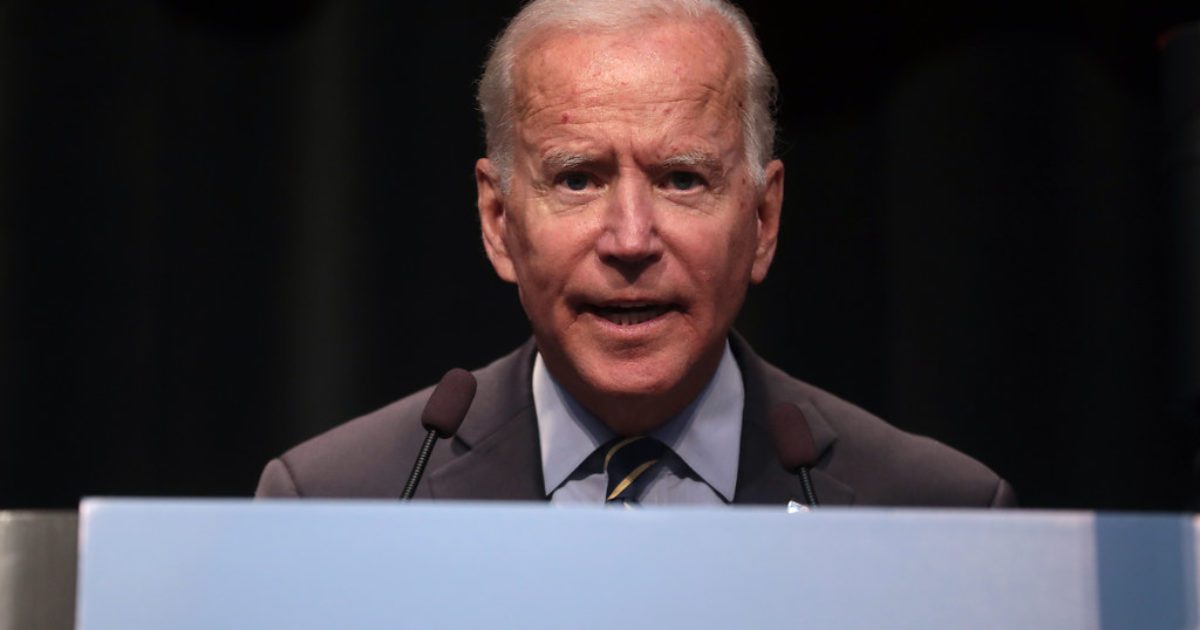

Joe Biden has made a living off of claiming that the rich don’t “pay their fair share” of taxes.

He’s said it numerous times over the last few weeks alone.

He’s also claimed that he has an economic plan that will change everything, including targeting those who use a popular tax avoidant trick, one that Biden himself may have abused.

A non-partisan government report was just released, which republicans allege raises the possibility that Biden himself owes as much as $500,000 in back taxes to the IRS.

This comes as Biden is pushing a $3.5 trillion bill to raise taxes on those who don’t “pay their fair share.”

The New York Post has more on Biden's possible tax troubles according to the government report:

Republicans say a new non-partisan report indicates President Joe Biden improperly avoided paying Medicare taxes before he took office — raising eyebrows and the possibility that he owes the IRS as much as $500,000 in back taxes.

Biden is leading a Democratic push for a $3.5 trillion bill to subsidize childcare, education and health care by targeting tax avoidance and raising tax rates on higher incomes so the rich “pay their fair share.”

A House Ways and Means Committee draft of the bill would end the accounting trick apparently exploited by Biden and boost IRS funding for audits — but the new report, drafted by the Congressional Research Service and provided to The Post, suggests Biden owes taxes under current rules, according to the congressman who requested it.

“Joe Biden wants to raise taxes by $2.1 trillion while claiming the rich need to pay their ‘fair share.’ But in 2017, multi-millionaire Joe Biden skirted his payroll taxes — the very taxes that fund Medicare and Obamacare,” said Rep. Jim Banks (R-Ind.), chairman of the conservative Republican Study Committee.

“According to the criteria CRS provided to my office, he owes the IRS and the American people hundreds of thousands of dollars in back taxes,” Banks said. “Every American should know about Joe Biden’s tax hypocrisy.”

Banks said the report shows Biden improperly used “S corporations” to avoid paying Medicare tax on speaking fees and book sales in 2017 and 2018.

Biden and first lady Jill Biden routed more than $13 million through S corporations and counted less than $800,000 of it as salary eligible for the Medicare tax — exempting the rest from what would have been a 3.8 percent rate, the Wall Street Journal reported.

The CRS report doesn’t name Biden but analyzes cases in which the IRS won a judgment against taxpayers who paid themselves suspiciously low salaries from S corporations and counted most of the revenue as “distributions” exempt from the Medicare tax.

“Courts have agreed with the IRS that shareholder-employees are subject to employment taxes when shareholders take distributions, dividends, or other forms of compensation in lieu of reasonable compensation,” the report says.

The document outlines several examples, including a case involving an accountant named David Watson who piped about $200,000 per year of his firm’s revenue through an S corporation while deeming just $24,000 of it as taxable salary. Courts determined he dramatically underpaid his taxes.

Significantly, the CRS report notes that presidential tax returns are subject to automatic audit only for years when a president is in office. The White House said this year that the Biden S corporations are dormant, meaning the IRS won’t automatically review their use.

Biden, who has branded himself “Middle Class Joe,” routinely argues the rich must “pay their fair share.”

Fox News has more details:

Banks said the report indicated that Biden improperly used "S corporations" while he and First Lady Jill Biden raked in over $13 million on speaking fees and book sales in 2017 and 2018, but counted less than $800,000 of it as a salary that could be taxed for Medicare.

Biden leading the charge to pass a $3.5 trillion bill that would help fund childcare, education, and health care. In order to help pay for the cost of the massive legislation, Biden's plan calls for targeting tax avoidance while raising taxes on people in high-income brackets who Biden claims don't "pay their fair share."

A draft of the bill includes a provision that would close loopholes similar to the one Biden used, though the report indicates that Biden would still owe taxes under the current rules, as well.

The report does not name the president, but it analyzes cases where the IRS won a judgment against taxpayers who improperly exploited the S corporations to avoid the Medicare tax.

But when the Bidens released their tax returns during his presidential campaign, they showed that the couple saved up to $500,000 by avoiding the 3.8% self-employment tax with the S corporations.

Biden has been quite busy lately talking about the wealthy not paying their fair share.

Check out his twitter feed alone over the last few weeks:

Well, he's correct about one thing...

This isn't right...

I hope Biden's economic plan holds himself accountable.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!