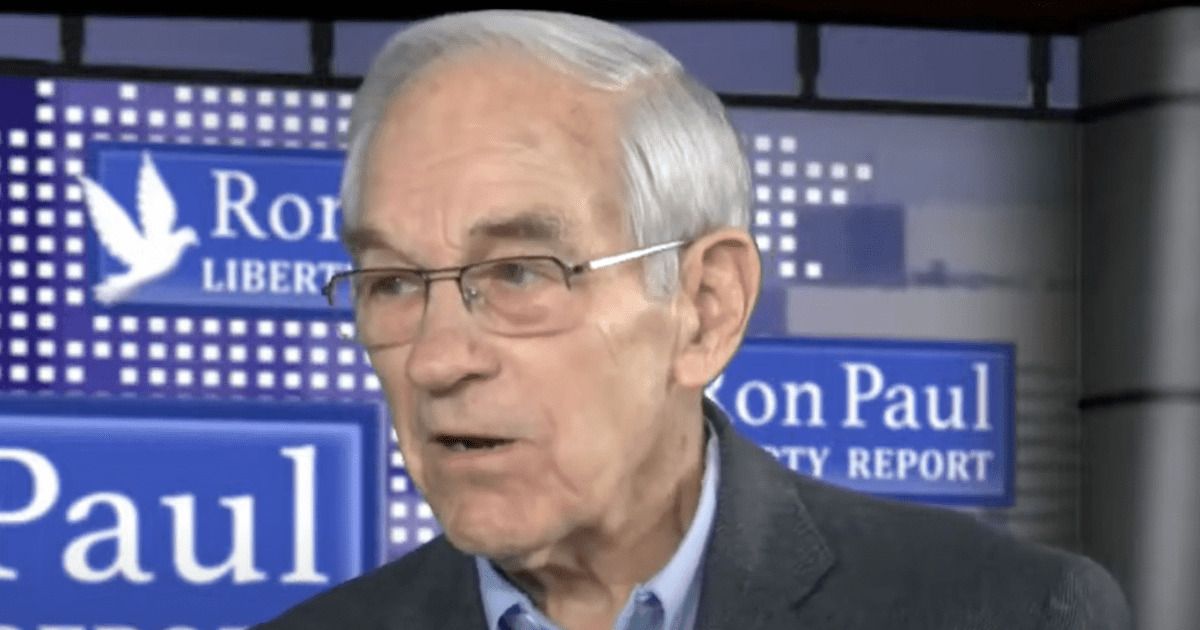

Ron Paul is one of the ONLY politicians I respected.

I miss him, and I wish he had played a bigger role in politics when he was in politics, but oh well.

He is probably the only politician I have ever heard seriously talk about the horror of The Federal Reserve Bank.

This behemoth that inflates money, and undermines personal liberty to the max. They Are slave drivers who control us using inflation.

Why won’t the Fed allow an audit?

Why do they keep enabling The U.S. Government to CONTINUE to run massive bailouts?!

A $1400 stimulus is nice, but not if the monetary supply inflates to match the crazy spending by D.C. oligarchs.

Check it out:

NOQ Report had the article by Ron Paul here:

According to the Congressional Budget Office (CBO), 2021 will be the second year in a row in which the federal debt exceeds Gross Domestic Product (GDP). CBO also projected that this year’s federal deficit will be 2.3 trillion dollars, which is 900 billion dollars less than last year. However, CBO’s projections do not include the 1.9 trillion dollars “stimulus” bill Congress is likely to pass.

The CBO’s report was largely ignored by Congress and the media. One reason the report did not get the attention it deserves is Federal Reserve Chairman Jerome Powell’s continued commitment to making sure Fed policies enable Congress to spend as much as Congress deems necessary to address the economic fallout from the coronavirus panic.

As financial analyst Peter Schiff points out, the Fed’s commitment to ensuring the government can run up massive debt means the Fed will not allow interest rates to increase to anywhere near what they would be in a free market. This is because increasing interest rates would cause the federal government’s debt payments to rise to unsustainable levels. Yet, the Fed cannot admit it is going to keep rates near, or even below, zero indefinitely without unsettling the markets. So, the Fed continues to promise interest rate hikes in the future and the markets pretend to believe the Fed. When (or if) the lockdowns end, the Fed will find a new crisis justifying “temporarily” keeping interest rates low.

CNBC had more:

The U.S. Federal Reserve won’t step in to temper rising inflation any time soon, market watchers have said, despite surging yields that have roiled global stock markets.

Stocks have been tethered over the past week to rising Treasury yields and the possibility that the Fed will tighten monetary policy to tackle an expected rise in inflation.

On Thursday, Fed Chairman Jerome Powell acknowledged that “some upward pressure on prices” could occur as the economy reopens, noting that he expects the central bank to be “patient” on policy action even if the economy sees “transitory increases in inflation.”Though the Fed has consistently vowed to keep its monetary policy accommodative and suggested employment and inflation are still well below target, Powell’s comments sent the benchmark U.S. 10-year Treasury yield back above 1.5% and rattled global stock markets. That yield hit an intraday high of 1.626% on Friday after a solid jobs report.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!