Is the longest economic recovery in American history going to run even longer?

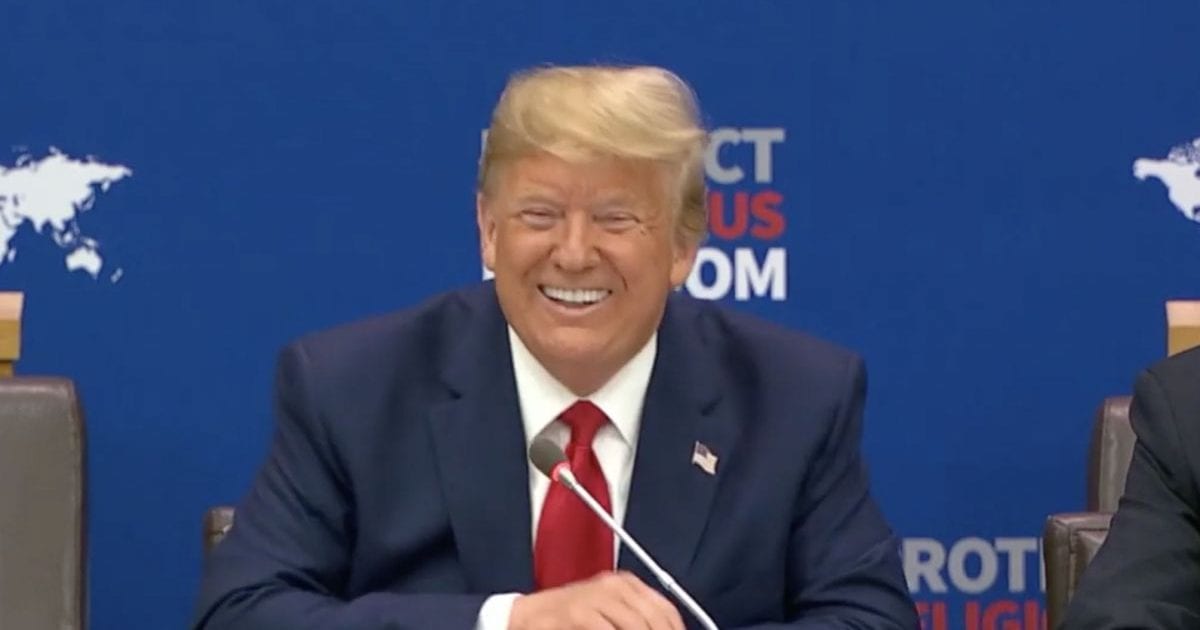

It will if President Trump has anything to say about it.

Trump’s tax cuts energized the U.S. economy, leading to job numbers that outperform expectations and unemployment rates hitting record lows.

Now, the Trump administration has announced that Tax Cuts 2.0 is “absolutely” coming… maybe as soon as September!

Politico reports:

President Donald Trump’s long-promised “Tax Cuts 2.0” plan will be released in September, with a 10 percent cut for middle-income taxpayers under discussion, a top White House official said today.

“In a meeting in the Oval, I guess two days ago, he looked at me and he said, ‘Let’s get it out by September,”National Economic Council Director Larry Kudlow told Fox Business Network. “We’d love to have a 10 percent middle-class tax cut, and we would love to strengthen and make permanent some of other tax cuts.”

“It will come out sometime in September,” he said.

Trump Tax Cuts 2.0 would give the middle class a 10 percent break.

But that's not all.

It would also seek to make the Tax Cuts and Jobs Act of 2017 (Tax Cuts 1.0) permanent.

Fox Business confirms the statement by Kudlow:

The administration, he said, will likely use the Office of Management and Budget Director Russell Vought's $1.4 trillion budget request to craft the package and make tax cuts permanent.

Kudlow said the administration plans to give the middle class a 10 percent tax cut in addition to strengthening and making permanent "some of the other tax cuts."

Many of the individual tax cuts in the Tax Cuts and Jobs Act of 2017 expire in 2025.

In addition to major tax cuts for the middle class, the plan is reported to include incentives for more Americans to invest in the stock market and retirement plans.

Several proposals are being considered as part of the upcoming economic stimulus package.

The incentive would allow a portion of income to become tax-free for investment purposes.

CNBC explains the current proposal under consideration:

As part of a forthcoming package of proposed tax cuts, the White House is considering ways to incentivize U.S. households to invest in the stock market, according to four senior administration officials familiar with the discussions.

The proposal, one of many new tax cuts under consideration, would see a portion of household income treated as tax-free for the purposes of investing outside a traditional 401(k). Under one hypothetical scenario described by multiple officials, a household earning up to $200,000 could invest $10,000 of that income on a tax-free basis, although officials noted these numbers are fluid.

“Nothing’s ruled out,” said one senior administration official. “Nothing’s been ruled in, either.”

Larry Kudlow, director of the National Economic Council, told CNBC the approach looked at most closely centers on creating universal savings accounts, which would combine retirement, education and health care savings into one vehicle.

Money put into the account would be done so on an after-tax basis, and taxed when withdrawn as well; but any accumulation of profits during the investment timeframe, known as capital gains, would not be taxed. Kudlow told CNBC this policy, if pursued, may extend to bonds as well as stocks.

Whatever the final version of Trump Tax Cuts 2.0 ends up being, it's clear the president will set up a contract with Democrats in time for the November election.

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!