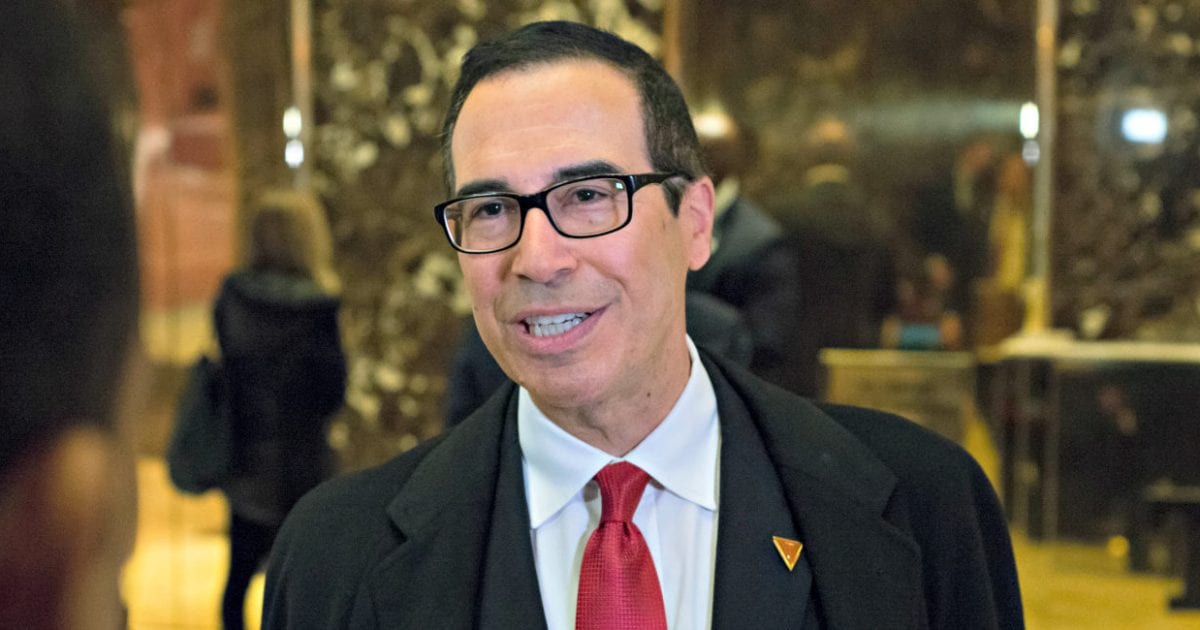

Treasury Secretary Mnuchin has released an analysis of the Trump/GOP tax cut bill.

His findings indicate that GDP will be boosted so much by the prosperity of businesses and workers that government revenue should actually INCREASE due to the cut.

It won’t be taken as gospel, since Mnuchin was appointed by Trump. But it’s a breath of fresh air compared to all of the phony push-polls and “analyses” coming out against the tax cut.

Read More: Roy Moore Accuser’s Evidence Was HOAXED!

Trending: President Trump BLASTS RINO Bill Barr

More from Newsmax:

Treasury Secretary Steven Mnuchin released a long-awaited analysis of the GOP tax plan, saying the Senate proposal would help to generate $1.8 trillion in additional revenue over 10 years, paying for the tax cuts through economic growth.

Gross domestic product would increase by 2.9 percent, as a result of cuts for corporations, so-called pass through businesses and individuals as well as regulatory overhaul, welfare cuts and infrastructure changes, according to the one-page report released Monday. That would lead to revenue generation of $1.8 trillion, more than offsetting the plan’s almost $1.5 trillion cost.

An analysis released by Congress’s official scorekeeper the Joint Committee on Taxation previously found that the Senate tax bill would generate enough economic growth to lower its $1.4 trillion revenue cost by only about $458 billion over a decade.

“We acknowledge that some economists predict different growth rates,” Treasury wrote in the document.

Treasury’s inspector general has an open investigation into whether political considerations interfered with Mnuchin’s promised analysis of the tax proposal. The inquiry was launched after The New York Times reported that Treasury had not completed the analysis Mnuchin had touted.

Releasing a one-page analysis or bill is a favorite trick of classical economists, as a means of showing how simple economic principles work in action.

Needless to say, liberal tax-and-spend advocates hate that!

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!